Contact Us

3V Learning Centre

Block 4, Unit 7,

2, Araromi Street, Off Moloney street,

Behind Access Bank, Obalende,

Lagos Island, Lagos, Nigeria.

Phone:

+2348080016941,+2348099614641,

Whatsapp

+2348080016941,+2348099614641,

+2348023306865

Our Opening Hours

CFA

- Details

- Category: CFA

- Hits: 78427

Thank you for your interest in our classroom tuition, kindly check below for details.

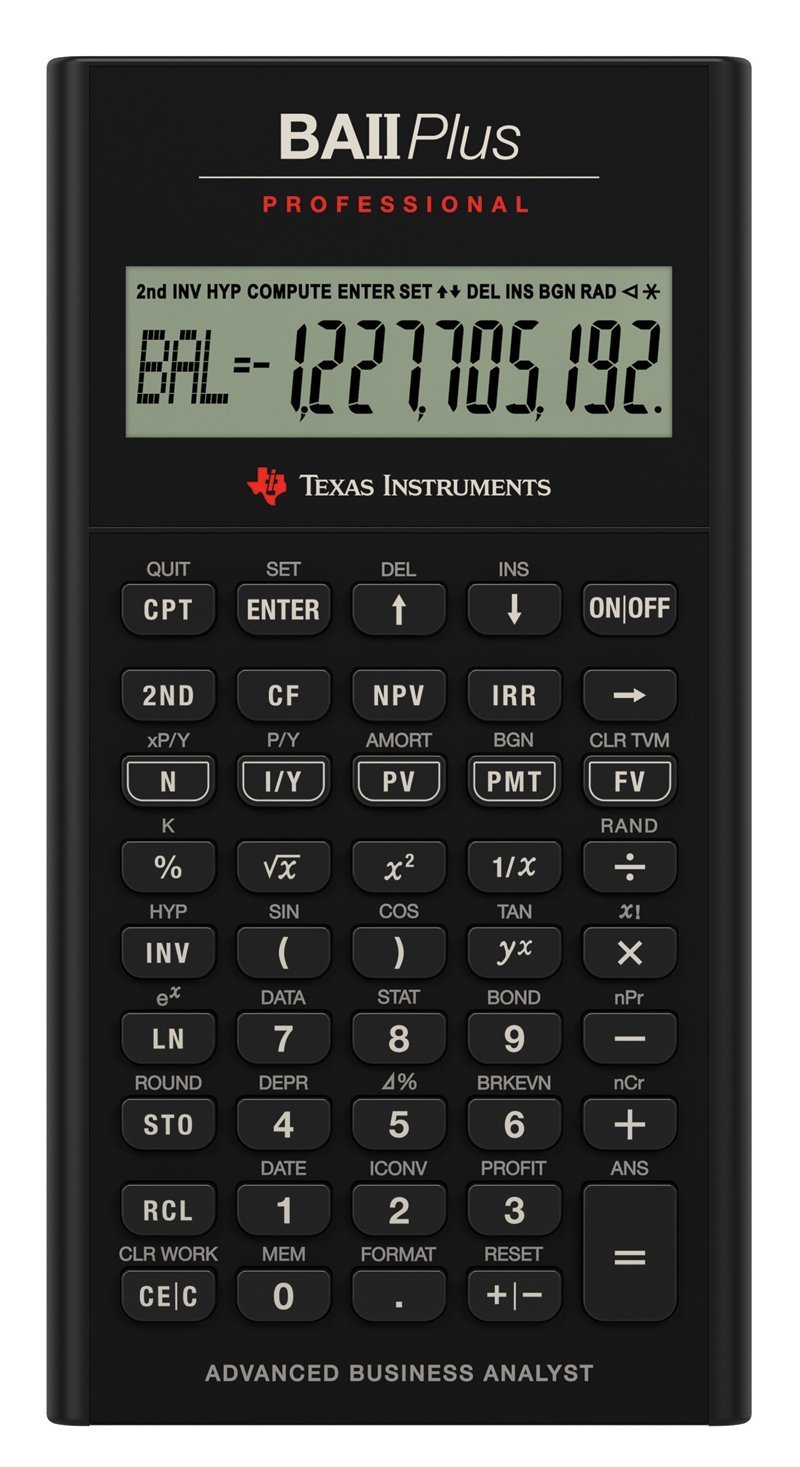

The Chartered Financial Analyst® (CFA®) designation is an international professional certification offered by the CFA® Institute Level I Focus: Level I provides a strong foundation in investment knowledge and the tools needed to apply these concepts in practice. Format: The Level I exam consists of 180 multiple choice questions, split between two 135-minute sessions (session times are approximate). There is an optional break between sessions. Level II - Focus: Level II emphasizes asset valuation and includes applications of the tools and concepts learned in Level I. Structure: The CFA Level II exam consists of 22 item sets comprised of vignettes with 88 accompanying multiple-choice questions. Duration: The Level II exam will be 4 hours and 24 minutes, split into two equal sessions of 2 hours and 12 minutes, with an optional break in-between. - Topics: The Level II exam covers topics like ethics and professional standards, quantitative methods, economics, financial reporting and analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, portfolio management. Level III Focus: Level III focuses on portfolio management and wealth planning, and tests the candidate's ability to synthesize and apply concepts from the entire curriculum. Format: The following exam format changes will take immediate effect beginning with the February Level III exam. - Topics: The Level III exam covers portfolio management and wealth planning, along with ethics and professional standards. Structure: The Level III exam consists of item sets comprised of vignettes with accompanying multiple-choice items and constructed response (essay) questions. All questions must be answered based on the information in the vignette. Hence, the items are not free-standing, as in the CFA Level I exam. You will need to refer to the vignette before answering each item. Duration: The Level III exam will be 4 hours and 24 minutes, split into two equal sessions of 2 hours and 12 minutes, with an optional break in-between. Passing and Grading CFA exams are scored on a 0-100 scale. To pass each level, candidates need to achieve a minimum passing score, which is determined by the CFA Institute based on the difficulty of the exam. The pass rate varies from year to year and level to level. CFA® Institute does not endorse, promote warrant the accuracy or quality of [3V Learning Centre]. CFA® and Chartered Financial Analyst® are registered trademarks owned by CFAInstitute 1. The basic entrance requirements for the CFA® Program include: Level 1 Level 2 Level 1 To enroll kindly fill the registration forms below Kindly note that we receive payments through cheque, Online transfer and Pos at the office. Our Account Details below: Account Name: 3V Learning Centre Guaranty Trust Bank Plc. Kindly note that you can make payment early to ensure you receive the listed materials below immediately before class commence. Location Lectures are held at our office in 5 Adefolu Drive, off Bamishile Street, off Allen Avenue, Ikeja, Lagos. Facilities Our CFA classes offer a comprehensive learning environment with the following amenities: Join our CFA classes and take advantage of a supportive and resource-rich environment designed to help you excel in your certification journey. Are you preparing for your CFA® exam and in need of the CFA® approved calculator, then contact us to buy one in Nigeria. We have the Texas Instruments BA II Plus Professional Financial Calculator in stock. Here is a list of it's features: The best-selling financial calculator from Texas Instruments just got better! In addition to standard capabilities such as time-value-of-money, accrued interest, amortization, cost-sell-margin, and depreciation. The Texas Instruments BA II PLUS PROFESSIONAL features even more time-saving calculations to make short work of complex equations. It's ideal for finance, accounting, economics, investment, statistics, and other business classes, as well as on the Chartered Financial Analyst® (CFA®) exam. The Texas Instruments BA II PLUS PROFESSIONAL also includes: (Delivery cost within Lagos will be calculated base on location) For outside Lagos (#5000 and above) shipping cost depends on states. The Texas BA II PLUS PROFESSIONAL are approved for use on the following professional exams: For more information or to enrol, Kindly contact us by mail or phone.

(formerly AIMR®) to financial analysts who complete a series of three examinations. To become a CFA® Charterholder candidates

must pass each of three six-hour exams, possess a bachelor's degree (or equivalent, as assessed by CFA® institute) andhave 48 months

of qualified, professional work experience. CFA® charterholders are also obligated to adhere to a strict Code of Ethics and Standards

governing their professional conduct.

Requirements

Commencement Date

January 13th, 2024

January 27th, 2024

Commencement Date

June 29th, 2024

Payment for Classes

Account Number: 0118389397FCMB

Account Number: 0741580026

Time:

Saturday 9:00 - 6:00pm

Sunday 12:00 - 6:00pm

Tuition fee:

Level 1

#210,000 (if paid once) #230,000 (if paid over 2 installments)

Level 2

#240,000 (if paid once) #260,000 (if paid over 2 installments)

Cost: #140,000

You can call our support line for purchase.+2348080016941, +2348051649248, +2348099614641, +2348023306865

Or you can email us for more details.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone: 08080016941, 08099614641,![]() Whatsapp only 08023306865, 08132569664

Whatsapp only 08023306865, 08132569664

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Category: CFA

- Hits: 34381

Chartered Financial Analyst® Exam Fees

CFA® Exam Fees 2024

- Feburary 2024

- May 2024

- August 2024

- November 2024

Feburary 2024 Exam (Levels I only)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum eBook version only.

Early Registration

Opens

16 May 2023 -

21 June 2023

Standard Registration

deadline

22 June 2023 -

8 November 2023

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Total

$1,290 (#1,196,800)

$1,600 (#1,482,000)

Fees calculated at the rate of #920 to dollars, current rate will apply when paying. All payment inclusive of processing fees

Feburary 2023 Exam (Levels I only)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum in print version.

Early Registration

Opens

16 May 2023 -

21 June 2023

Standard Registration

deadline

22 June 2023 -

8 November 2023

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Curriculum Print version

$150 shipping

$150 shipping

Total

$1,440 (#1,334,800)

$1,750 (#1,620,000)

Fees calculated at the rate of #920 to dollars, current rate will apply when paying.

May 2024 Exam (Levels I, II, and III)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum eBook version only.

Early Registration

Opens

15 August 2023 -

26 September 2023

Standard Registration

deadline

27 September 2023 -

06 February 2024

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Total

$1,290 (#1,196,800)

$1,600 (#1,482,000)

Fees calculated at the rate of #920 to dollars, current rate will apply when paying. All payment inclusive of processing fees

May 2024 Exam (Levels I, II, and III)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum in print version.

Early Registration

Opens

20 August 2020 -

3 November 2020

Standard Registration

deadline

4 November 2020 -

23 February 2021

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Curriculum Print version

$150 shipping

$150 shipping

Total

$1,440 (#1,334,800)

$1,750 (#1,620,000)

Fees calculated at the rate of #920 to dollars, current rate will apply when paying. All payment inclusive of processing fees

August 2024 Exam (Levels I, and II)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum eBook version only.

Early Registration

Opens

14 November 2023 -

09 January 2024

Standard Registration

deadline

10 January 2024 -

14 May 2024

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Total

$1,290 (#1,196,800)

$1,600 (#1,482,000)

Fees calculated at the rate of #920 to dollars, current rate will apply when paying. All payment inclusive of processing fees

August 2024 Exam (Levels I and II)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum in print version.

Early Registration

Opens

14 November 2023 -

09 January 2024

Standard Registration

deadline

10 January 2024 -

14 May 2024

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Curriculum Print version

$150 shipping

$150 shipping

Total

$1,440 (#1,334,800)

$1,750 (#1,620,000)

Fees calculated at the rate of #600 to dollars, current rate will apply when paying. All payment inclusive of processing fees

November 2024 Exam (Levels I and III)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum eBook version only.

Early Registration

Opens

08 February 2024 -

20 March 2024

Standard Registration

deadline

21 March 2024 -

07 August 2024

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Total

$1,290 (#1,196,800)

$1,600 (#1,482,000)

Fees calculated at the rate of #920 to dollars, current rate will apply when paying. All payment inclusive of processing fees

November 2024 Exam (Levels I and III)

Three payment option are available for the exam. With this fee, you will receive the CFA® Program curriculum in print version.

Early Registration

Opens

08 February 2024 -

20 March 2024

Standard Registration

deadline

21 March 2024 -

07 August 2024

Program Enrollment

(new Level I only)

$350

$350

Exam Registration

$940

$1,250

Curriculum Print version

$150 shipping

$150 shipping

Total

$1,440 (#1,334,800)

$1,750 (#1,620,000)

Fees calculated at the rate of #920 to dollars, current rate will apply when paying. All payment inclusive of processing fees

Testimonials

Anonymous

I bought and used your e-learning packs for my ACCA exam, for F5, F6 and F7 and i pass them. It really help me tremendously. Looking forward to buying for other papers. Thanks

Chigozie

CISA December 2016

The workload for some of us took a toll on preparing for the exam, sincerely attending classes helped a great deal. The experience and examples shared by the tutors were such one need not miss. THANKS TO GOD ALL THE SAME

Bukky

I bought the vTutor packs for my ACCA F2 anf F7 exam. I enjoyed how the tutor taught each topic which made it very simple for me to understand the papers. Nice work 3VLC, keep it up.

Joseph

CFA December 2018

Special thanks to 3VLC for their sound lectures and hospitality.

Joy

CFA Distance Learning

I bought your video tutorial to prepare in Port-Harcourt and found them to be of great help in helping understand and pass my CFA Level 1. Highly recommended.

Request a Phone Call

Have an Enquiry or Question?

Do you have an enquiry you would like to make, enter your name and phone number and we will call you back.