Contact Us

3V Learning Centre

Block 4, Unit 7,

2, Araromi Street, Off Moloney street,

Behind Access Bank, Obalende,

Lagos Island, Lagos, Nigeria.

Phone:

+2348080016941,+2348099614641,

Whatsapp

+2348080016941,+2348099614641,

+2348023306865

Our Opening Hours

Uncategorised

- Details

- Category: Uncategorised

- Hits: 2664

Making payment for ACCA exam Fees

Are you interested in making payment for your ACCA exams, our service saves you time of moving around because all you need to do is just make a call. You can call our helpline 08023306865, 017398858, 08079074882, 08099614641 for more details about making payment for your exam, subscription, exemption and more.

Are you interested in making payment for your ACCA exams, our service saves you time of moving around because all you need to do is just make a call. You can call our helpline 08023306865, 017398858, 08079074882, 08099614641 for more details about making payment for your exam, subscription, exemption and more.

| ACCA Registration and Subscription fees |

|

| Initial Registration | £77 (2012) |

| Initial Registration (Cost in Naira) | #24,000 (Admin fee inclusive) |

| Subscription | £77 (2011) |

| Re-registration fee | £77 in addition to any amounts unpaid at the time of resignation/removal. |

ACCA Exam fee for June and December 2012

The closing dates for early, standard and late exam entry are easy to remember - 8 is the date!

| ACCA Exam Entry Closing dates | Exam entry method |

|---|---|

| December exams | |

| 8 September | Early exam entry (online only) |

| 8 October | Standard exam entry (online and paper) |

| 8 November | Late exam entry (online only) |

| June exams | |

| 8 March | Early exam entry (online only) |

| 8 April | Standard exam entry (online and paper) |

| 8 May | Late exam entry (online only) |

ACCA Qualification fees

| Exam level | Exam entry period | June 2012 exam fee (per exam) | December 2012 exam fee (per exam) |

|---|---|---|---|

|

Knowledge Papers |

Early | £55 (#14,300) | £60 (#15,600) |

| Standard | £64 (#16,600) | £69 (#17,940) | |

| Late | £192 (#49,900) | £200 (#52,000) | |

|

Skills Papers |

Early | £69 (#17,900) | £75 (#19,500) |

| Standard | £80 (#20,800) | £86 (#22,360) | |

| Late | £208 (#54,100) | £217 (#56,420) | |

|

Professional Papers |

Early | £81 (#21,100) | £88 (#22,880) |

| Standard | £94 (#24,500) | £101 (#26,260) | |

| Late | £222 (#57,700) | £231(#60,060) | |

| Fees calculated at the rate of #260 to pounds, current rate will apply when paying. | |||

Foundations in Accountancy fees

| Exam level | Exam Entry Period | June 2012 exam fee (per exam) |

December 2012 exam fee (per exam) |

|

FA1 and MA1 |

Early | £38 (#9,880) | £42 (#10,920) |

| Standard | £44 (#11,440) | £48 (#12,480) | |

| Late | £172 (#44,720) | £180 (#46,800) | |

|

FA2 and MA2 |

Early | £38 (#9,880) | £42 (#10,920) |

| Standard | £44 (#11,440) | £48 (#12,480) | |

| Late | £172 (#44,720) | £180 (#46,800) | |

| FAB, FMA, FFA | Early | £55 (#14,300) | £60 (#15,600) |

| Standard | £64 (#16,600) | £69 (#17,940) | |

| Late | £192 (#49,900) | £200 (#52,000) | |

| Specialist (FTX, FAU, FFM) | Early | £55 (#14,300) | £60 (#15,600) |

| Standard | £64 (#16,600) | £69 (#17,940) | |

| Late | £192 (#49,900) | £200 (#52,000) | |

| Fees calculated at the rate of #260 to pounds, current rate will apply when paying. | |||

- Details

- Category: Uncategorised

- Hits: 33006

Entry requirements for ACCA Qualification

ACCA QUALIFICATION GRADUATE-ENTRY ROUTE

- Relevant degree holders from ACCA-accredited institutions may be exempted from all nine exams within the Fundamentals level and register directly at the Professional level. Degrees with some relevance may also qualify for exemptions

- For B.sc in Accounting and Banking and Finance and HND in Accounting, you are qualified for exemption in four Papers after submitting your transcript. The four Papers are:

F1 Accountant in Business AB

F2 Management Accounting MA

F3 Financial Accounting FA

F4 Corporate and Business Law CL - For ICAN ACA students, you will be exempted from all nine exams within the Fundamentals level and register directly at the Professional level after submitting your transcript.

Exemption Granted

F1 Accountant in Business AB

F2 Management Accounting MA

F3 Financial Accounting FA

F4 Corporate and Business Law CL

F5 Performance Management PM

F6 Taxation TX

F7 Financial Reporting FR

F8 Audit and Assurance AA

F9 Financial Management FM - B.sc Economics/Bus Administration

For B.sc Economics/Bus Administration, you are qualified for exemption

F1 Accountant in Business AB

Access to ACCA via Foundations in Accountancy

- If you do not meet the minimum entry requirements to start the ACCA Qualification which are OND, ND, HND, B.SC, B.TECH or any equivalent qualification, then you will need to start your exams by going through the Foundations in Accountancy courses before you can continue with the ACCA qualification. You must finish the Diploma in Accounting and Business that is three exams: Accountant in Business (FAB), Management Accounting (FMA) and Financial Accounting (FFA) and afterwards apply for transfer over to the ACCA Qualification. You will be exempted from F1, F2 and F3 and then you can writing writing your exams F4 Corporate and Business Law..

- Details

- Category: Uncategorised

- Hits: 43788

Exemption for ACCA Qualification

Are you planning on registering for the ACCA and wondering if you would qualify for any exemption. Any b.sc holder in any discipline are qualified to register for the ACCA, but exemption are only granted based on certain qualification which are:

To check for further exemption based on other qualification not listed, kindly click on the link below to visit acca global site for more exemption.

Exemptions Calculator

Basic Exemptions are:

B.sc or B.Com, HND Accounting, B.sc or HND Banking & Finance

Holder of these qualification are qualified for exemption for the papers below based on the understanding that they have already studied these courses while earning their degrees. These exemptions are:

F1 Accountant in Business AB

F2 Management Accounting MA

F3 Financial Accounting FA

F4 Corporate and Business Law CL

B.sc Economics/Bus Administration

Holder of these qualification are qualified for exemption for the papers below based on the understanding that they have already studied these courses while earning their degrees. These exemptions are:

F1 Accountant in Business AB

The Institute of Chartered Accountants of Nigeria (ICAN)

Holder of these qualification are qualified for exemption for the papers below based on the understanding that they have already studied these courses while earning their degrees. These exemptions are

Knowledge Module

F1 Accountant in Business AB

F2 Management Accounting MA

F3 Financial Accounting FA

Skill Module

F4 Corporate and Business Law CL

F5 Performance Management PM

F6 Taxation TX

F7 Financial Reporting FR

F8 Audit and Assurance AA

F9 Financial Management FM

So you will be writing only four papers to finish your ACCA qualification exam, which are below

Strategic Professional level (in which you will sit for a total of 4 papers - 2 core and two optional)

Strategic Professional

Essentials

Options

- Advanced Financial Management

- Advanced Performance Management

- Advanced Taxation (UK)

- Advanced Audit and Assurance (INT)

However, if you want to earn the b.sc degree in Applied Accounting from Oxford brookes University, then you will have to forfeit these papers and write them to be eligible for the degree.

F7 Financial Reporting FR

F8 Audit and Assurance AA

F9 Financial Management FM

B.sc in other discipline like Science, IT, Social Science and others.

for holder of these degree, there are no exemptions but your qualification are eligible for registration for the ACCA. Upon registration, you will be registered on the ACCA qualification routes, which means you will be writing fourteen (14) papers to finish your ACCA exam.

Applied Knowledge

Applied Skills

- Corporate and Business Law

- Performance Management

- Taxation

- Financial Reporting

- Audit and Assurance

- Financial Management

Strategic Professional level (in which you will sit for a total of 4 papers - 2 core and two optional)

Strategic Professional

Essentials

Options

- Details

- Category: Uncategorised

- Hits: 34693

The Association of Chartered Certified Accountants is an independent professional body of Chartered Accountants in the U.K. It was founded in 1904 and is the largest to operate on an international basis. It awards its own qualification after successful completion of the ACCA examinations and three years of practical experience.

The Association of Chartered Certified Accountants is an independent professional body of Chartered Accountants in the U.K. It was founded in 1904 and is the largest to operate on an international basis. It awards its own qualification after successful completion of the ACCA examinations and three years of practical experience.

Course Objectives

ACCA is not only about accounting. You will also develop a range of skills and knowledge in finance, taxation, audit, management, law, and banking.

The financial and technical experience you will gain en route to the ACCA qualification ensures that you can work anywhere within and outside Nigeria. Once qualified, there are no limits.

Testimonials

Anonymous

I bought and used your e-learning packs for my ACCA exam, for F5, F6 and F7 and i pass them. It really help me tremendously. Looking forward to buying for other papers. Thanks

Chigozie

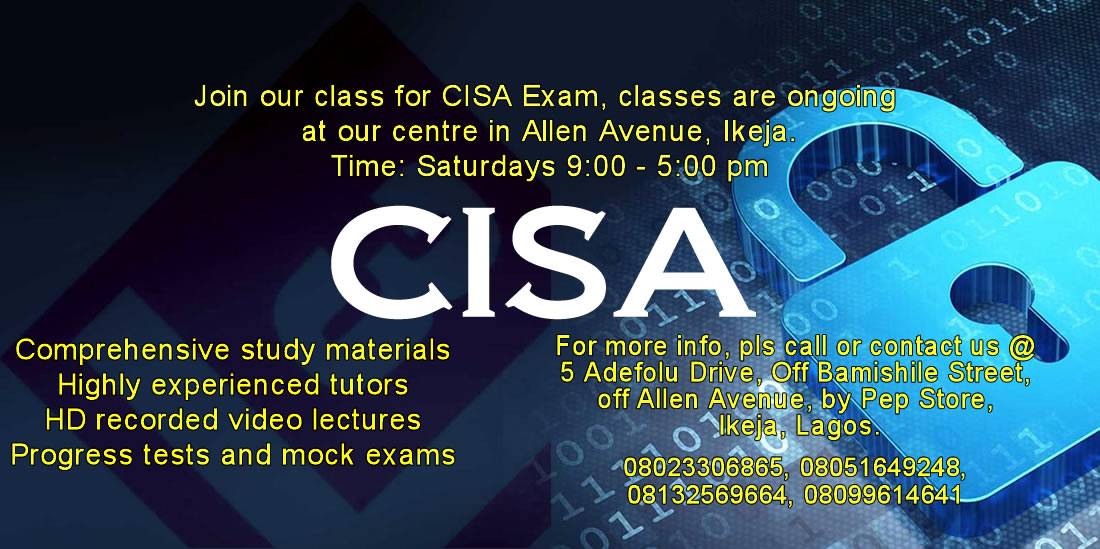

CISA December 2016

The workload for some of us took a toll on preparing for the exam, sincerely attending classes helped a great deal. The experience and examples shared by the tutors were such one need not miss. THANKS TO GOD ALL THE SAME

Bukky

I bought the vTutor packs for my ACCA F2 anf F7 exam. I enjoyed how the tutor taught each topic which made it very simple for me to understand the papers. Nice work 3VLC, keep it up.

Joseph

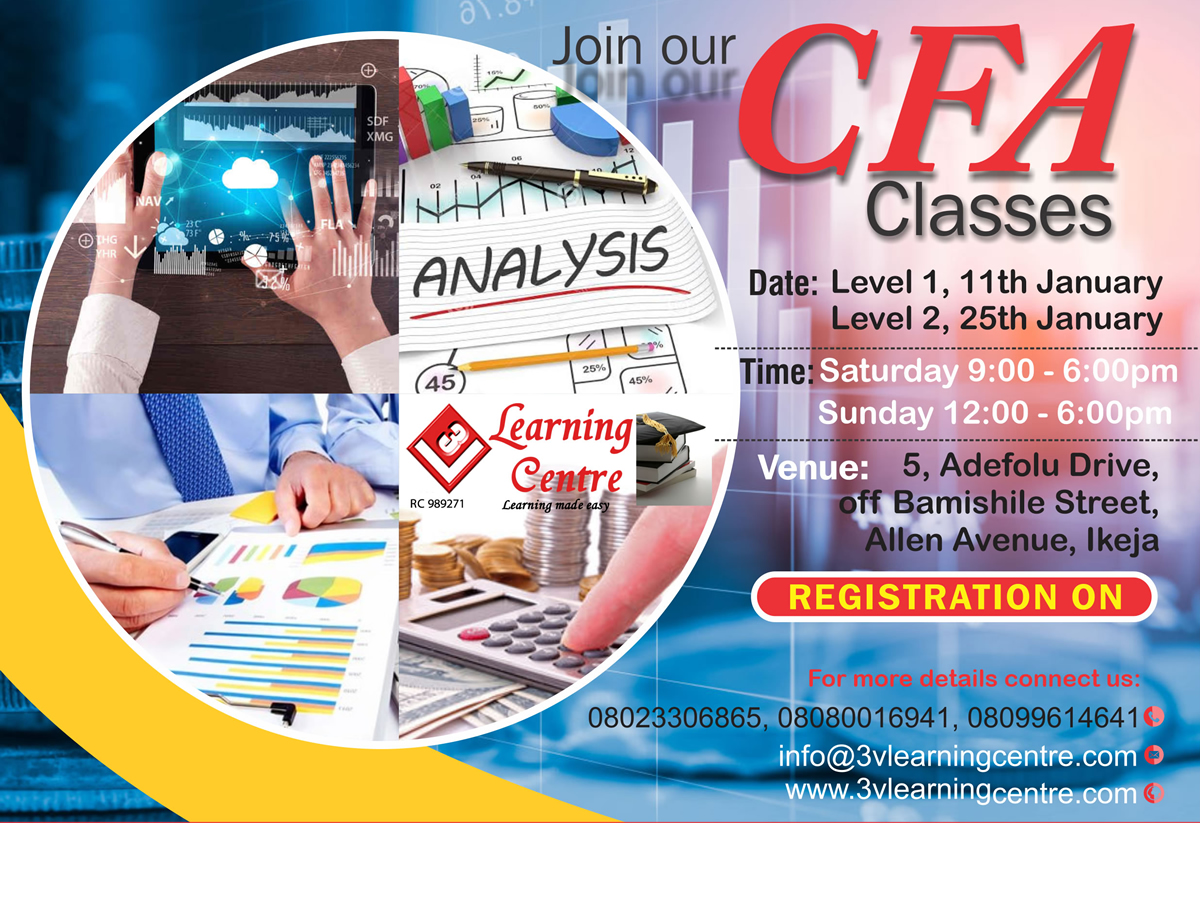

CFA December 2018

Special thanks to 3VLC for their sound lectures and hospitality.

Joy

CFA Distance Learning

I bought your video tutorial to prepare in Port-Harcourt and found them to be of great help in helping understand and pass my CFA Level 1. Highly recommended.

Request a Phone Call

Have an Enquiry or Question?

Do you have an enquiry you would like to make, enter your name and phone number and we will call you back.